Ein Form Describe Use of Employees

This ensures that every business entity has its own identification number which it uses for filing and paying taxes as well as for all other business uses. An EIN is an Employer Identification Number also known as a Federal Employer Identification Number FEIN or a Tax Identification Number TIN.

Ein Comprehensive Guide Freshbooks

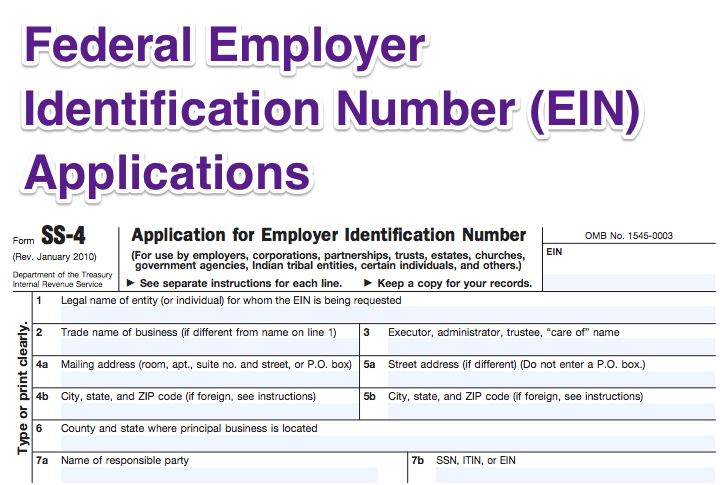

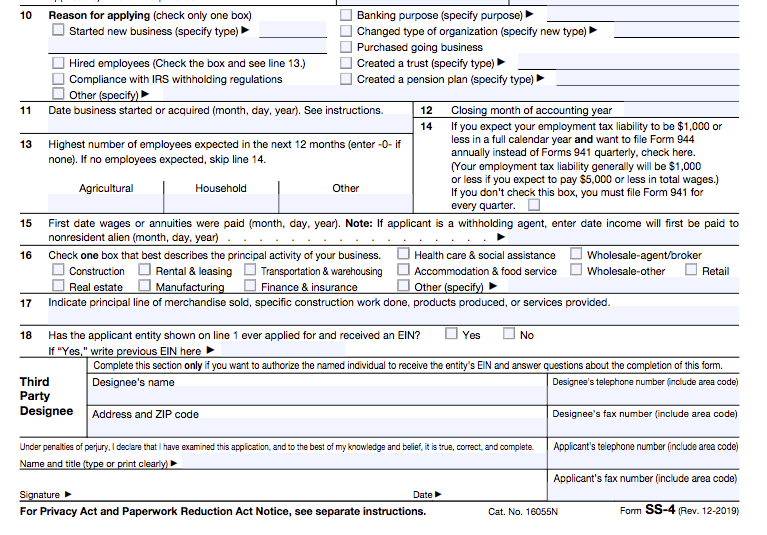

Use Form SS-4 to apply for an employer identification number EIN.

. Its also sometimes called a Federal Taxpayer Identification Number or Federal Employer Identification Number FEIN. Think of it as a Social Security number for your business entity. Copies can be requested online search Forms and Publications or by calling 1-800-TAX-FORM.

Sole proprietors can do business under their own Social Security numbers but they can apply for an EIN if they elect to do so. In many cases federal wage and tax limits cannot be carried over to a new EIN. Blocktenant association church church-controlled organization community or volunteer group employerfiscal agent under IRC Sec 3504 employer plan 401K money purchase plan etc farmers.

An online payroll service can help pay employees and even take care of payroll tax filings and payments. An EIN is a nine-digit number issued by the IRS that is not the same as an SSN. This requirement only pertains to employers with 250 or more employees and some other businesses over the threshold may be exempt.

IRS records will be updated immediately with your EIN. An EIN must appear on all forms filed as a household employer. Think of it as a Social Security number for your business entity.

Starting operating or buying a business Forming a limited liability company LLC corporation or partnership as a business structure Hiring employees Creating a trust estate or nonprofit entity Filing businessemployer taxes Complying with the IRS Filing. The form is for corporations partnerships estates and trusts. As of January 2 2020 OSHA requires all employers to electronically submit an employer identification number EIN from the Internal Revenue Service IRS along with the report for fatality injury and illness Form 300A.

Every business except for certain sole proprietorships that do. The IRS clearly states in its instructions for Schedule H. Once connected with an IRS employee tell the assistor you received an EIN from the Internet but cant remember it.

If you dont have an EIN you may apply for one online. Any business that hires employees needs an EIN but most businesses even small business entities without employees have one. Dont use an SSN in place of an.

An EIN is a 9-digit number for example 12-3456789 assigned to employers sole proprietors corporations partnerships estates trusts certain individuals and other entities for. Social Security Number SSN individual taxpayer identification number ITIN and an employer identification number EIN. An Employer Identification Number or EIN is an identification number issued to organizations to identify who must file a business tax return.

Visit IRSgov and enter EIN in the search box or use this link IRS EIN. International applicants may call 267-941-1099 not a toll-free number 6 am. The IRS requests that all business or entity information associated with the EIN number to be correct at all times.

An Employer Identification Number EIN is a nine-digit number used by the Internal Revenue Service IRS to identify businesses and certain other entities. The person making the call must be authorized to receive the EIN and answer questions concerning the Form SS-4 PDF Application for Employer Identification Number. To get an EIN you usually need an SSN or an ITIN.

Commonly known as an EIN serves as an identifier for federal tax purposes. The EIN assigned is the permanent Federal Employer Identification Number for your business. Click the button on the right hand side to apply for an EIN online for any one 1 of the following legal entities.

If incorrect information in the EIN application form SS-4 has been filed with the IRS or the information has subsequently changed after the initial EIN application filing the IRS must be informed of the information changes. Employer Identification Number. An Employer Identification Number EIN is used to identify a business for tax purposes with the Internal Revenue Service IRS.

Please use one of our other methods to. Form SS-4 is used by sole proprietors corporations partnerships estates trusts and other entities to apply for an EIN. Form SS-4 can be.

You may also apply for an EIN by faxing or mailing Form SS-4 to the IRS. The W-3 or Transmittal of Wage and Tax Statements is the form employers use to report employee wages and tax withholdings to the Social Security Administration SSA and its filed annually. The EIN is a unique number that identifies the organization to the Internal Revenue Service.

An EIN is similar to a social security number for your business. Simply call 800 829-4933 and select EIN from the list of options. An employer ID number.

To apply for an employer identification number you should obtain Form SS-4 PDF and its Instructions PDF. Part of what makes the W-3 unique is that each employer only has to file one form as it. This EIN may be cancelled if the name or social security number of the principal officer do not match the social security administration records or if your business already has an EIN.

EIN For Other Entities. Eastern Time Monday through Friday to obtain their EIN. Although EIN is short for Employer Identification Number it acts as a national identifier for a business.

Which leaves foreign individuals who cant obtain either. Employee Identification Number EIN This form of identification is used for all types of businesses including limited liability companies LLCs corporations and partnerships. But for business owners with employees form W-3 is just as important.

EINs are issued to any person business or other entity that pays employee withholding taxes. IRS Form SS-4 is a business application for an employer identification number EIN. Employers outside of the United States may also apply for an EIN by calling 267-941-1099 toll call.

Many people use the catch-all term of a TIN which refers to a Taxpayer Identification Number. Business owners use an EIN to conduct activities that would. There are three different types of numbers the IRS uses for tax purposes.

We recommend employers download these publications from IRSgov. In the United States an EIN is the business and corporate equivalent to the Social Security number. The IRS uses EINs to identify and track employers and their employees.

We cannot process your application online if the responsible party is an entity with an EIN previously obtained through the Internet. The form and the number establish a business tax account with the IRS. Dont use a social security number in place of an EIN Schedule H is the form families file with their personal tax returns to report their household employment taxes.

Every organization must have an employer identification number EIN even if it will not have employees. Examples of how an EINs are used include. Form 941 is filed quarterly by EIN with the IRS to report wages and federal payroll taxes Federal Income Social Security and Medicare Taxes.

If youre wondering about the differences between a TIN and an EIN SSNs and ITINs are.

Fillable Form 433f 2017 Certificate Of Participation Template Fillable Forms Internal Revenue Service

What Is An Fein Federal Ein Fein Number Guide Business Help Center

0 Response to "Ein Form Describe Use of Employees"

Post a Comment